Data as of 1st november 2024

The Bond Opportunities Basket tracker certificate

Maturité: open end

The Bond Opportunities Basket tracker certificate is denominated in USD, it is made up of a selection comprising a minimum of 5 securities and a maximum of 20. The underlying assets are bonds, bond ETFs and various cash pockets. It is of the “open end” type, which means that it does not have a defined maturity date. The investment universe is made up of government and/or corporate bonds that must have an S&P rating of at least BB. The exchange rate risk may be hedged from time to time by forward exchange transactions.

Key data

| Residence | Lausanne (BCV) |

| Issuing company | Banque Cantonale Vaudoise (AA) |

| Investment Manager | Multi Group Finance SA |

| ISIN | CH1172510344 |

| Reference currency | USD |

| Launch date | 9 mai 2022 |

| Redial frequency | 24 x par an |

| Minimum denomination | USD 5’000 |

| Management method | Dynamique |

| Maximum weight of a title | 5% |

| Minimum issue size of a security | 200 Mio |

| Entrance fee | Non |

| Exit fee | Non |

| Performance Fee | Non |

| Value number | 117251034 |

| Replication method | Full réplication |

| Using Coupons | Accumulation |

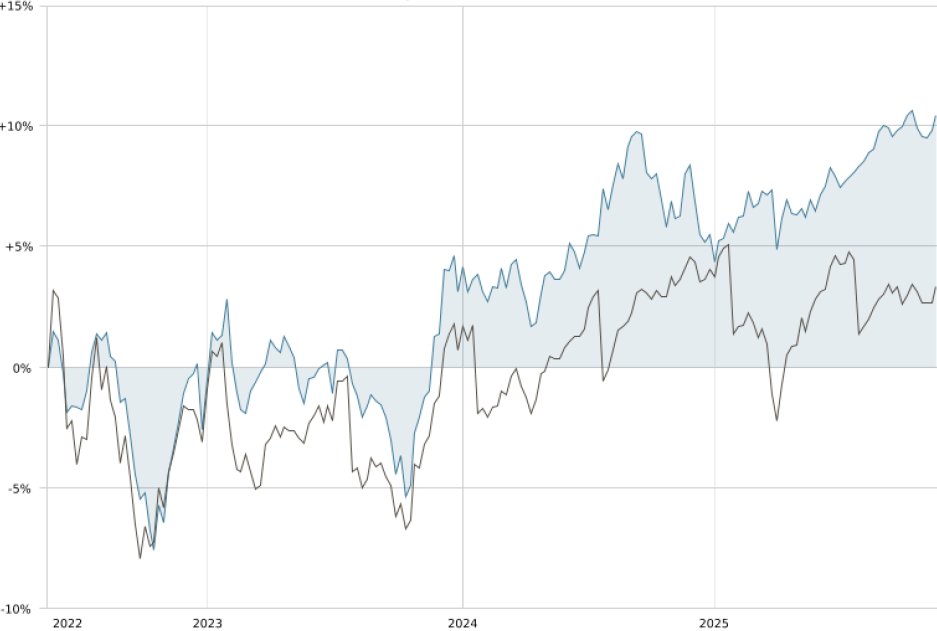

| Benchmark | Barclays USD High Yield Bond |

| Minimum investment | 1 certificat |

| Final date | sans |

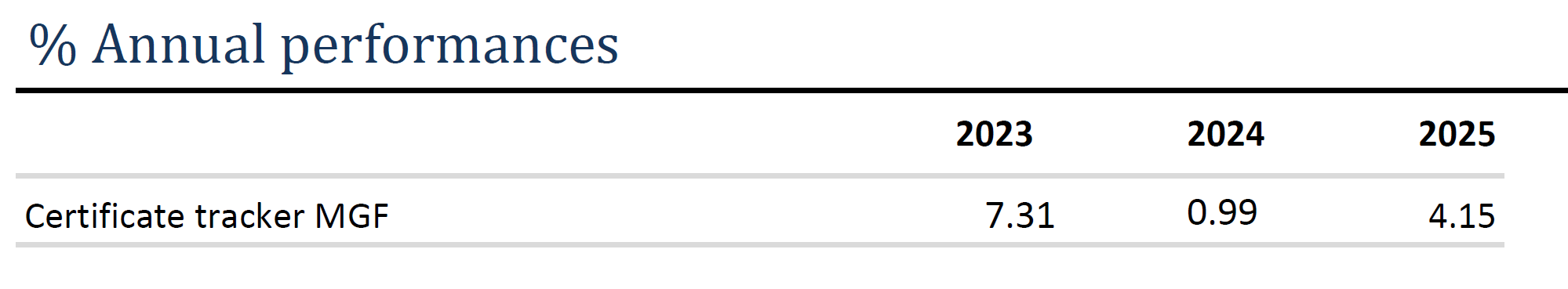

Annual Performances %

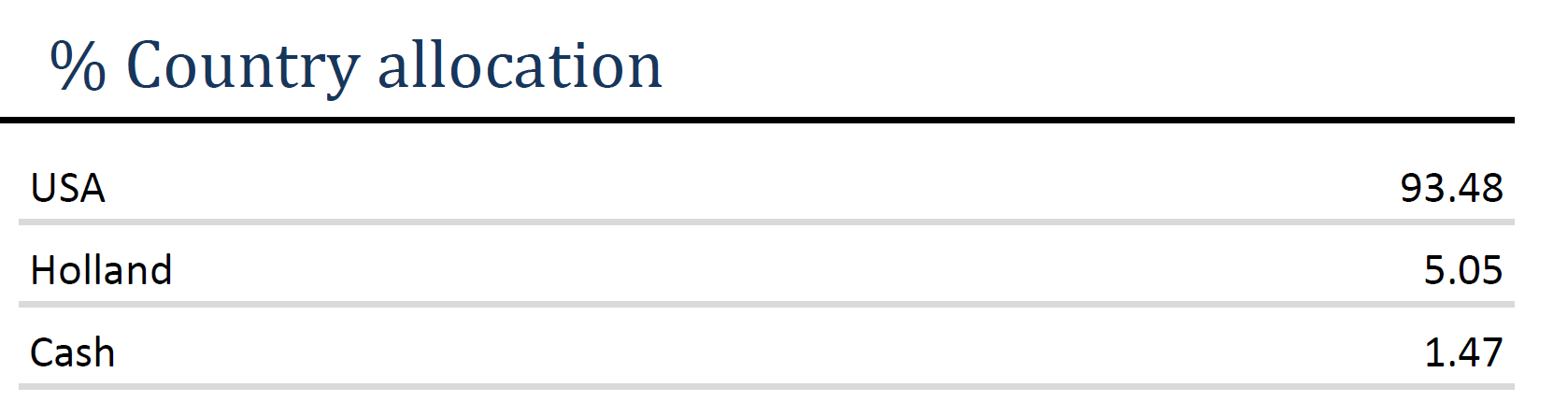

Allocation by country %

Performance summary %

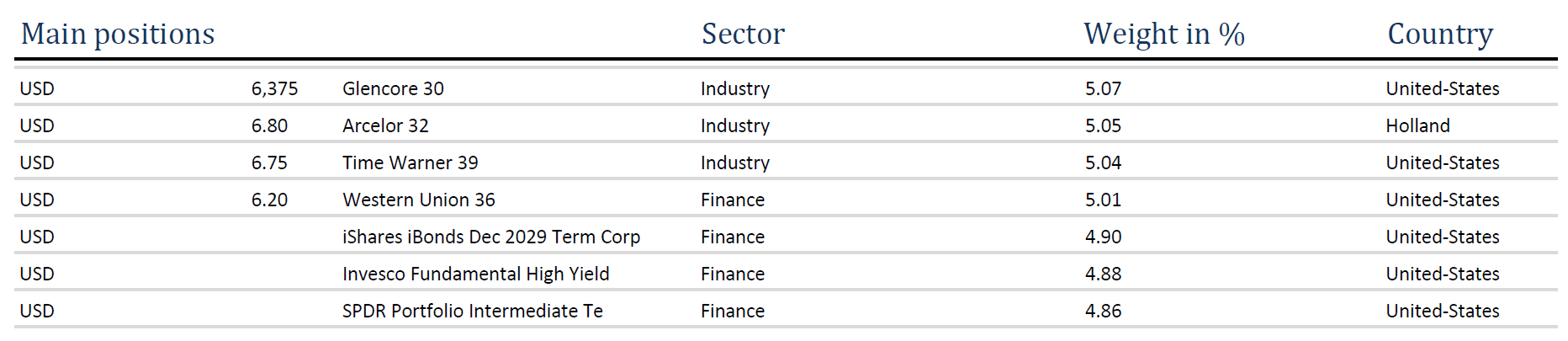

Main Positions

Past performance is not an indicator of future results. This product is not a collective investment within the meaning of the Federal Act on Collective Capital Investments (CISA) and is therefore not subject to authorization or supervision by the Federal Financial Market Supervisory Authority (FINMA). The investor also bears issuer risk (AA). This certificate is actively managed in a discretionary and dynamic manner by MGF.

Certificat Tracker MGF Bond Opportunity

December 2025

all our

Services

Wealth

Management

Tracker

Bond

Tracker

Equity

Other

Services